An Unbiased View of $100 Loan Instant App

Wiki Article

4 Simple Techniques For Loan Apps

Table of ContentsSome Of Best Personal LoansThe Definitive Guide to Instant LoanInstant Loan Can Be Fun For AnyoneInstant Cash Advance App for BeginnersThe Definitive Guide for Instant Cash Advance AppThe 8-Second Trick For Best Personal Loans

When we think about obtaining fundings, the imagery that comes to mind is people aligning in lines, waiting on many follow-ups, as well as obtaining entirely frustrated. Innovation, as we know it, has altered the face of the lending service. In today's economic situation, customers as well as not lending institutions hold the trick.Financing authorization and paperwork to lending processing, everything is online. The many relied on online lending apps use customers a platform to get financings conveniently and also offer authorization in mins. You can take an from a few of the most effective money car loan applications offered for download on Google Play Shop as well as App Shop.

You just need to download the application or most likely to the Pay, Feeling website, register, upload the required records, as well as your financing will obtain approved. You will certainly get informed when your car loan request is processed. Generally loan application made use of to take at the very least a couple of days. In many cases, the loan approval made use of to get extended to over a month.

The Main Principles Of $100 Loan Instant App

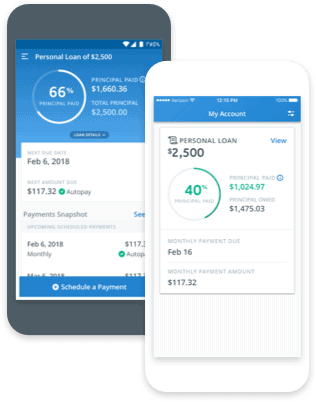

Frequently, even after obtaining your financing authorized, the process of getting the financing quantity moved to you can require time as well as obtain complicated. Yet that is not the situation with on-line lending applications that offer a direct transfer choice. Instant car loan apps use instantaneous individual finances in the series of Rs.

5,00,000 - instant cash advance app. You can avail of an immediate loan as per your qualification and require from instant financing apps. You do not have to worry the next time you desire to obtain a small-ticket funding as you know how useful it is to take a lending utilizing on the internet funding applications. So, do away with the taxing and tiresome procedure of get typical individual lendings.

Everything about Loan Apps

You can be sure that you'll obtain a sensible interest rate, tenure, financing quantity, and various other benefits when you take a funding with Pay, Feeling Online Lending App.An electronic borrowing platform covers the whole lending lifecycle from application to dispensation into consumers' bank accounts. By digitizing and automating the loaning process, the platform is transforming traditional banks right into electronic lenders. In this write-up, allow's explore the advantages that an electronic borrowing system can offer the table: what remains in it for both banks as well as their customers, as well as just how digital borrowing platforms are disrupting the market.

Every bank now wants every little thing, consisting of car loans, to be refined quickly in real-time. Clients are no longer eager to wait for days - not to mention to leave their houses - for a car loan.

The 25-Second Trick For $100 Loan Instant App

Today's Gen, Z and also millennials can not live without their smart device. All of their daily activities, including monetary purchases for all their activities and they choose doing their monetary deals on it also. They desire the benefit of making deals or making an application for a lending anytime from anywhere. It's extremely hard to please.In this case, digital financing platforms serve as a one-stop service with little hand-operated data input and also rapid turnaround that site time from click now funding application to money in the account. Consumers need to have the ability to relocate seamlessly from one gadget to another to complete the application, be it the web and mobile user interfaces.

Suppliers of electronic borrowing systems are needed to make their products in conformity with these regulations and also aid the lending institutions focus on their organization just. Lenders additionally needs to make sure that the carriers are upgraded with all the latest guidelines released by the Regulators to promptly integrate them into the digital lending system.

Little Known Questions About $100 Loan Instant App.

As time passes, electronic loaning systems can help conserve 30 to 50% overhead expenses. The conventional hands-on loaning system was a pain for both lending institution and also customer. It counts on human intervention and also physical communication at every step. Clients needed to make numerous journeys to the banks as well as send all sort of papers, and also manually fill out numerous kinds.The Digital Borrowing platform has actually altered the means banks think of and apply their finance procurement. Banks can currently release a fully-digital lending cycle leveraging the most up to date innovations. A terrific electronic lending system should have easy application entry, quick approvals, compliant more helpful hints borrowing procedures, and the ability to continuously enhance procedure performance.

If you're thinking of going into borrowing, these are comforting numbers. At its core, fintech is all about making conventional monetary processes faster and much more efficient.

The Definitive Guide to Instant Cash Advance App

Among the usual false impressions is that fintech apps just profit banks. That's not totally real. The application of fintech is currently spilling from banks as well as lending institutions to tiny organizations. This isn't surprising, because local business require automation as well as digital innovation to optimize their restricted sources. Marwan Forzley, CEO of the payment system Veem, amounts it best: "Tiny services are wanting to outsource intricacy to someone else because they have sufficient to stress over.A Kearney study backs this up: Source: Kearney As you can see, the ease of usage covers the listing, showing just how accessibility as well as convenience given by fintech platforms stand for a massive driver for client loyalty. You can use many fintech innovations to drive customer depend on and retention for organizations too.

Report this wiki page